Our Investment Philosophy

We believe in a prudent, strategic approach to portfolio management grounded in financial science and real-world results and designed to help you address your lifetime financial goals. There are five key concepts which play a vital role in the construction of every portfolio we manage.

Markets Work

Instead of trying to beat the market, we believe that you should let the market work for you. In 1965, University of Chicago economics professor, Eugene Fama, developed The Efficient Markets Hypothesis. According to Fama's research, it is nearly impossible to consistently “beat” the markets using stock selection or market timing. Instead, we believe investors should focus on capturing the capital markets' long-term rates of return.

Risk & Return are Related

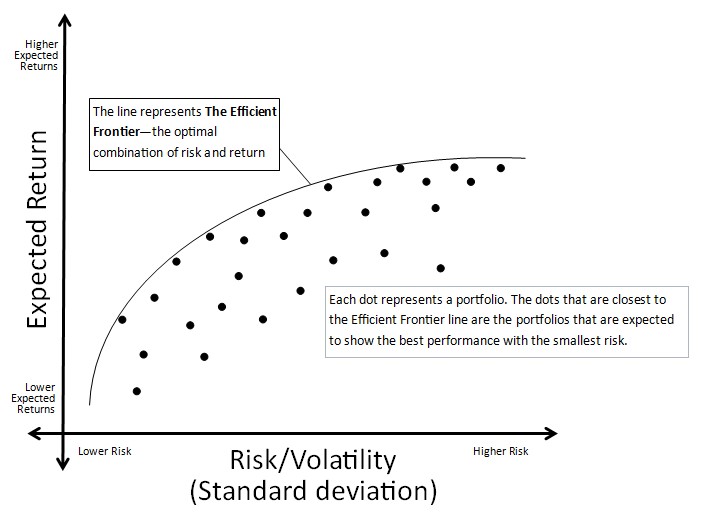

Markets can be chaotic, but over time they have shown a strong relationship between risk and reward. This means that the compensation for taking on increased levels of risk is the potential to earn greater returns. As such, we begin with a risk tolerance questionnaire to determine your budget for risk. Then we seek to create a portfolio that optimizes returns for your given level of risk.

Diversify with Structure

When it comes to investing, risk cannot be eliminated, but it can potentially be reduced or mitigated through a prudent, structured approach:

- Combine Multiple Asset Classes that have historically experienced dissimilar return patterns across various financial and economic environments.

- Diversify Globally — 60% of global stock market value is non-U.S., and international stock markets as a whole have historically experienced dissimilar return patterns to the U.S.

- Invest in Thousands of Securities to potentially limit portfolio losses by reducing company-specific risk.

- Invest in High-Quality Fixed Income to lower historical correlations with stocks and decrease default risk.

- Invest in Non-Correlated Assets, including real estate, REITS (real estate investment trusts), to provide potential income that is not directly correlated with the stock or bond markets.

Investing involves risk including the potential loss of principal. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy, such as asset allocation, can guarantee a profit or protect against loss in periods of declining values. Past performance is no guarantee of future results. Please note that individual situations can vary. Therefore, the information presented here should only be relied upon when coordinated with individual professional advice.

Customize Your Portfolio

Traditionally many portfolios have been built using average historical returns and volatility of returns. We take portfolio modeling to the next level by analyzing what really matters to you — downside risk (the likelihood that an investment will decline in value) and the degree to which you are focused on asset preservation versus asset growth. While our portfolios vary in terms of composition and asset class weighting, they all are designed and managed to:

- Keep Costs Low

- Minimize Taxes

- Control Risks

The end result: a portfolio focused on trying to deliver expected rates of return for your chosen level of risk.

Invest for the Long Term

We believe a long-term perspective is one of the most important ingredients of portfolio success. Stay patiently invested and don't try to time the ebb and flow of the market. And be sure to rebalance your portfolio periodically to keep it aligned with your goals. Above all, don't go it alone. Working with an independent advisor at The Alameda Financial Group may help you stay on track towards addressing your long-term investment goals. We can help you manage the emotions of investing and keep you from making hasty, ill-considered decisions. As Investment Advisor Representatives, we have an elevated duty of care, prudence, and diligence, and always put your interests first.